Follow this PROVEN Content Calendar Daily through Q2

Every Monday

Instagram Story:

Deal Of The Week

Instagram Story:

Deal Of The Week 2

Text Message:

Deal of the Week

Hey [First Name],

Hope you're well. I know that you're not in the market right now, but I just came across a property in [area] that might be one of the very best deals on the market.

Here are the details:

- [feature 1]

- [feature 2]

- [feature 3]

- [feature 4]

Who do you know in your network that's in the market and might be interested?

Email:

🏡 Deal of the Week

Hey, I've just come across a property that might actually be one of the VERY best deals on the market.

It's a single family home in Calgary's ultra-desirable NW for UNDER $400K!

Here's why I love it:

1140 sq. ft. with 3 bedrooms up!

Detached Double Garage

$290,000 LESS than the average single family home!

Could possibly add a secondary suite!

Great investment potential!

Shoot me a reply if you want more info on this one, I'd be surprised if it lasts the weekend...

Sincerely,

[Your Name]

Letter:

Deal Of The Week

Tuesday, July 8

What happens when rates dip?

When mortgage rates shift—even slightly—it doesn’t just affect what buyers can afford.

It affects how confident they feel.

We’ve seen this pattern again and again: As rates dip, even a little, buyers gain purchasing power. And when that happens, buyers who’ve been hesitant tend to re-engage.

Redfin data shows that when rates dropped from just over 7% to 6.67%, a buyer with a $3,000/month budget gained $16,000 more in purchasing power.

On a $441,000 home, that same change lowered the monthly payment by nearly $100.

More importantly, it boosted buyer confidence—often seen in faster tours, quicker decisions, and fewer concessions.

It doesn’t take a major rate drop to change the mood of the market—just enough movement to give people permission to act.

P.S. If your real estate plans for the summer have changed, reach out anytime. Happy to help in any way I can.

Wednesday, July 9

Text Message:

Buyer Budget Text

Hey Tom—

Just read that a buyer with a $3K/month budget gained $16K in purchasing power after rates dipped recently.

Out of curiosity, do you have a monthly budget in mind?

Thursday, July 10

Friday, July 11

IG Shareable

Why Clients Choose Nest When the Stakes Are High

Tuesday, July 1st

Email:

"How to avoid losing $23,000 if you sell your home in 2025”

Let’s imagine you recently decided to list your home.

You priced it high—”just to see what happens.”

The photos looked fantastic. The listing video—great. And when your agent texted you “We’re live 🎉” you found yourself envisioning constant showing requests, positive feedback, and multiple offers.

But instead, the house sits on the market for weeks. A handful of showings. A few neighbors at the Open House. No offers.

Now what?

Eventually, you adjust the price.

But by then, buyer interest has cooled. Your days-on-market have climbed. And you’ve now paid 2–3 extra months of mortgage, taxes, insurance, and utilities—just to end up selling for the price you could’ve listed at from the start.

That’s how a $500,000 home turns into a $23,000 mistake.

This is one of the most common scenarios that sellers in this market go through. But it’s avoidable…

With the right pricing strategy from day 1. :)

Here if you need me.

P.S. If you haven’t received your 2025 home value report yet—and you’re curious to know how much you could sell for—reply to this email and I’ll prepare one for you.

Wednesday, July 2nd

Text Message:

Past Client Check-In

[Property Address] just came on the market and I immediately thought—’[First Name] and [First Name] would love this spot.’

Hope you guys are doing well. 🙂

How closely have you been following the market?

Thursday, July 3rd

IG Shareable

“Most Overrated Neighborhood?”

Tuesday, June 17th

Email:

"Is this why more homeowners are selling in 2025?”

We don’t talk enough about the total cost of homeownership.

It’s not just the mortgage. It’s insurance, property taxes, maintenance, and repairs—the less visible costs that add up fast.

According to Bankrate, the hidden cost of owning a home now averages over $18,000 a year. That’s up 26% since 2020.

As expenses rise, a lot of my clients are asking—Are we paying more to stay than we would to move?

If you’re in a similar position—or know someone who is—here’s a good starting point:

Gather your financials: Current mortgage, taxes, insurance, utilities, maintenance, planned renovations, plus expected costs if you buy (purchase price, down payment, closing, moving).

Run side-by-side comparisons: Use mortgage and cost calculators that factor in all

upfront and ongoing expenses for both your current home and a potential new one.

Assess total costs and personal fit: Look at monthly and long-term expenses over 5–10 years, and weigh them against how long you plan to stay and your lifestyle priorities.

As always, if you have any questions—or need guidance because you feel like you’re stuck in limbo—I’m here.

Sincerely,

Text Message:

Shaw Energy Solar Summer Promo

Hey (name) - it's (agent name). Hope the family is doing well.

I'm not sure if you've been keeping up with the news but THIS SUMMER will most likely be the FINAL time ⏰ to save 30% off solar! Congress has pushed to end it.

You want me to put you in touch with my solar ☀️ pro? Our office partnered with them and they are zero pressure.

Wednesday, June 18th

Text Message:

The Off-Market Opener

Hey Tom—

This might be worth a quick conversation but I could be wrong.

I’ve been talking to my buyers who are very interested in seeing if they can find an off-market deal.

I know you’re likely NOT selling but is there a price that you’d at least consider?

p.s. I’d be terrible at my job if I didn’t at least ask. 🙂

Thursday, June 19th

IG Shareable

Every seller we work with has second thoughts right before we list. Here’s why →

Friday, June 20th

IG Shareable

[Your City] Propaganda I Am Absolutely Falling For

Tuesday, June 10th

Email:

"What would you do with $200K in equity?”

Homeowners pulled $25 billion in equity last quarter—the highest Q1 total since 2008, according to ICE Mortgage Technology.

Why does that matter?

Because HELOC rates have dropped by 2.5 percentage points, and homeowners are sitting on a record $11.5 trillion in tappable equity—averaging over $200,000 per mortgage holder.

That shift is already showing up in the market. Here’s what that looks like:

Some are renovating instead of relisting.

Others are consolidating debt or improving their buying power.

Parents are helping kids buy or funding second homes.

And yes—some are choosing to sell, using their equity to move, downsize, or trade up—without needing to refinance or borrow at today’s rates.

Homeowners aren’t just sitting on equity—they’re using it. And that’s already changing what we’re seeing in the market.

As always, I’ll keep watching the data and passing along what’s worth paying attention to.

P.S. If you’re curious how much equity you’ve built—and what you could do with it—I’m happy to help you run the numbers. Just reply to this email.

Text Message:

Shaw Energy Solar Summer Promo

Hey (name) - it's (agent name). Hope the family is doing well.

I'm not sure if you've been keeping up with the news but THIS SUMMER will most likely be the FINAL time ⏰ to save 30% off solar! Congress has pushed to end it.

You want me to put you in touch with my solar ☀️ pro? Our office partnered with them and they are zero pressure.

Wednesday, June 11th

Text Message:

Unsolicited CMA: $25B in Equity

Hey Tom—

Just read a wild stat and thought of you. Homeowners pulled $25B in equity last quarter—highest Q1 since 2008. The average owner’s sitting on $200K+ in tappable equity.

I’m pulling together an updated equity report for you—so you know exactly how much cash you could access if you ever wanted to renovate, consolidate debt, or make a move.

Have you made any home improvements recently I should factor in?

Thursday, June 12th

IG Shareable

What would you do with $200K in equity?

Friday, June 13th

IG Shareable

Houses that sold with Highest taxes in 2025 in [Area]

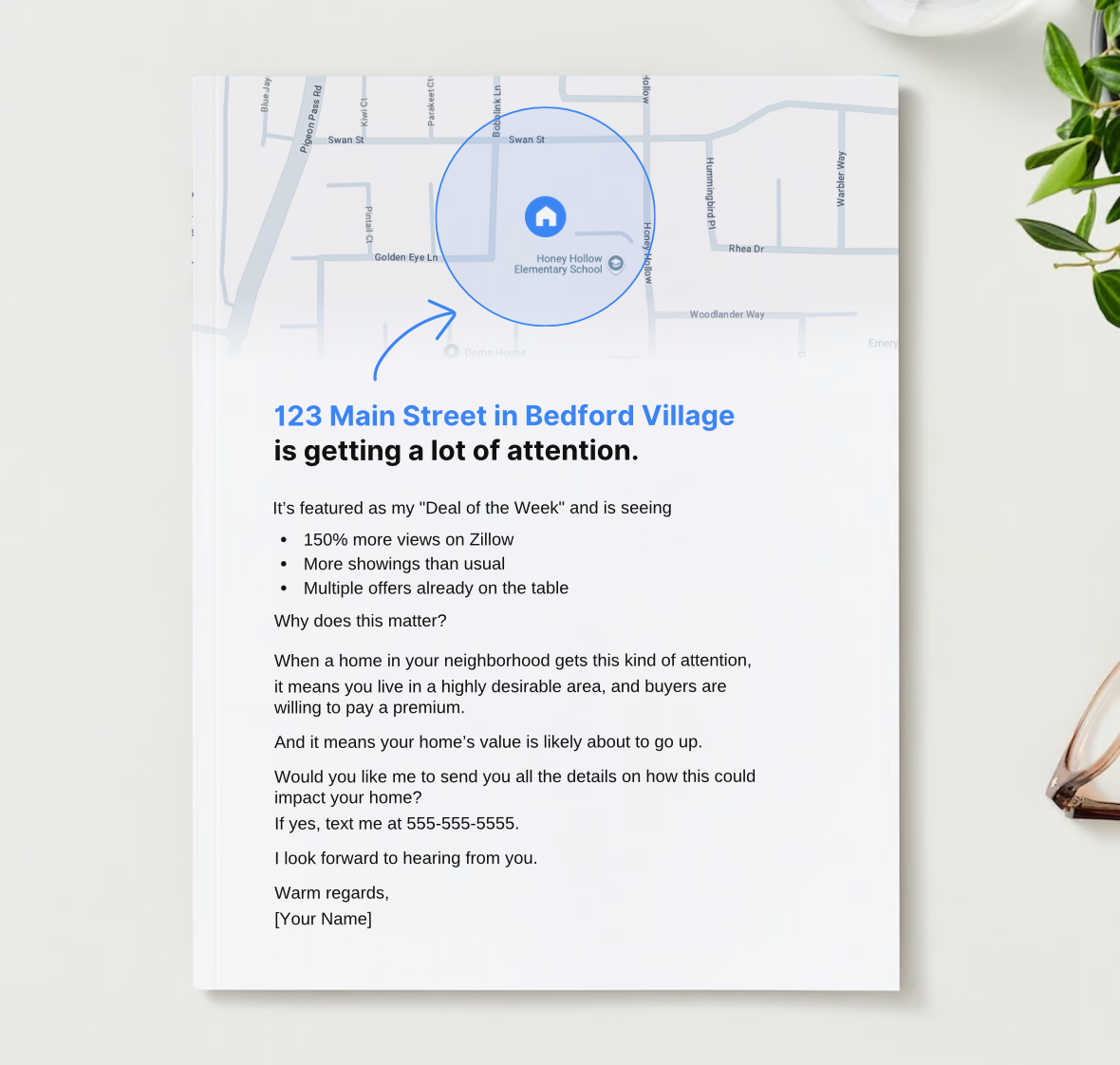

Mailer Template

Neighborhood Domination

Tuesday, June 3rd

Email:

"This just happened…but buyer demand still grew?”

Mortgage rates just hit their highest point since January.

By most assumptions, that should’ve put the brakes on demand.

And yet—according to the Mortgage Bankers Association—applications to purchase a home actually rose 2% last week. That’s 18% higher than the same week a year ago.

So who’s buying?

Buyers who’ve done the math. Who’ve decided that a slightly higher monthly payment is worth the tradeoff for finally finding the right space—or getting a deal that didn’t exist last year.

We’re seeing it across price points: buyers willing to engage, if the property—and the price—make sense.

With 38% of listings seeing price cuts and inventory up 32% from a year ago (Altos, via HousingWire), we’re also seeing sellers get more realistic.

That doesn’t mean homes are being given away—it means sellers are open to negotiating—on price, on timing, even on covering closing costs in some cases.

As always, if you have any questions—any questions at all about the market or what we’re predicting for this summer, just reply to this email. I’m here when you need me.

Text Message:

Shaw Energy Solar Summer Promo

Hey (name) - it's (agent name). Hope the family is doing well.

I'm not sure if you've been keeping up with the news but THIS SUMMER will most likely be the FINAL time ⏰ to save 30% off solar! Congress has pushed to end it.

You want me to put you in touch with my solar ☀️ pro? Our office partnered with them and they are zero pressure.

Wednesday, June 4th

Text Message:

1:1 Market Update

Hey Tom—

I just saw 123 Main Street sold in your neighborhood.

Would it be helpful if I sent over a quick market update from May?

Thursday, June 5th

IG Shareable

1 of 4 homes that just had a price drop

Friday, June 6th

Letter

Reasons why people are selling this summer

🎥 Video Template: 1 in 7 Homebuyers Are Backing Out

This template helps break down national cancellation trends and what it means for your local market. Use it to establish yourself as a trusted source for timely market insights.

Thumbnail Design

Get Canva ThumbnailCopy & Paste Content

Video Title

1 in 7 Homebuyers Are Backing Out | [Your City] Real Estate Market Update

Video Description

This week, we’re seeing key signs of a shifting market: a surge in deal cancellations, more listings coming online, and growing pressure on certain property types. In this update: - National cancellation trends every buyer and seller should understand - What rising inventory means for your pricing strategy - Local contract ratios and where demand is softening - What to expect as we head into [next month/season] Let’s dive into it.

Hashtags

#MortgageRates #CanceledContracts #InterestRates2025 #RealEstate2025 #SpringMarketUpdate #RealEstateInsights #MonthlyMarketUpdate

Full Video Script

According to Redfin, roughly 1 in 7 home purchase agreements were cancelled in April—marking the second-highest April cancellation rate on record. That’s not a surprise to anyone who’s been following along, but in today’s video, I wanted to go deeper and give you some research I did myself. In this week’s update, we’re breaking down what that means for buyers and sellers in [Your City/County]. We’re also tracking how different segments of the market are performing—and where conditions are shifting faster than others. Let’s take a look at what’s happening behind the scenes—nationally and locally. [0:45–1:30] According to Redfin, about 1 in 7 U.S. home purchase agreements fell through last month—roughly 14.3%. That’s one of the highest April cancellation rates on record (only April 2020 was higher). Why does that matter? Because April is historically one of the strongest sales months of the year. In [Your Area], we're starting to see similar signs: more listings coming back on market, buyer hesitation, and softening momentum. [1:30–2:15] Redfin also reported that new listings are up 8.4% year-over-year—the highest level in nearly 3 years. At the same time, HousingWire notes that 38% of active listings have had a price cut, and inventory is up 32% from a year ago (Altos Research). That might sound like a red flag—but it’s more nuanced than that. Pending sales are down in many markets, but nationally, mortgage purchase applications actually rose 2% last week, and are up 18% compared to this time last year. So what we’re seeing is a mixed picture: some buyers are backing out, while others are stepping in—especially if the price and terms make sense. If you're listing your home, pricing and presentation still matter—but so does understanding which segment you’re competing in. [2:15–3:00] This market does have a silver lining for buyers. With more listings and fewer active buyers, you're more likely to find a motivated seller—especially in categories where inventory is stacking up. Price drops are becoming more common, and we're even seeing homes with assumable mortgages. They’re not everywhere, but if you're looking to avoid today’s 7% rates, that could be a major opportunity. We’re still selling homes every week. But this market isn’t what it used to be—and it’s not coming back overnight. [3:00–4:30] Now let’s break it down by property type. We pulled the latest contract ratios, and across the board, most categories are down year-over-year: - Single-family homes: from [X]% to [Y]% - Townhomes: from [X]% to [Y]% - Condos/apartments: from [X]% to [Y]% Right now, the market is not a one-size-fits-all situation. That’s the key point I want to drive home: not all properties are performing the same. It really comes down to [Your Unique Insight i.e. presentation, price, # of bedrooms, square footage]. [4:30–5:30] Redfin forecasts a 1% national price dip by the end of the year. While some markets may be holding steady, others are already seeing more noticeable declines in certain property types. Meanwhile, mortgage rates continue to hover around 7%. If that holds, we’ll likely see continued buyer caution and longer days on market. [5:30–6:30] When we zoom in locally, we’re seeing big differences by neighborhood. [City/Submarket A] has lost some steam, while [City/Submarket B] has quietly gained traction. But across the board, supply is up and demand is lagging: - Supply: [X]% above normal - Demand: [X]% below normal This gap is why we’re firmly in a buyer’s market—even if it doesn’t feel like it yet in certain zip codes. [6:30–7:00] If you learned something new today, please give this video a like and subscribe to the channel. My team and I are experts in this market—very few people have [Your Unique Selling Proposition i.e. have sold more condos in the area in the past 5 years]. Want a custom breakdown for your property or zip code? Send me a quick message, or drop a comment. I’ll send you a no-pressure, data-backed report you can use to plan your next move.

Tuesday, May 27th

Email:

"I started to think about selling but stopped because…”

There’s been a lot of noise in the headlines lately—but we’re actually seeing strong activity in our local market heading into the summer.

Out of curiosity—could you finish this sentence for me?

“I started to think about selling but stopped because…”

I don’t want to give up my low interest rate.

I’m worried I won’t be able to find a new home.

I’m concerned about the economy / job market.

I can’t wait to hear your answer! 🙏

Text Message:

Shaw Energy Solar Summer Promo

Hey (name) - it's (agent name). Hope the family is doing well.

I'm not sure if you've been keeping up with the news but THIS SUMMER will most likely be the FINAL time ⏰ to save 30% off solar! Congress has pushed to end it.

You want me to put you in touch with my solar ☀️ pro? Our office partnered with them and they are zero pressure.

Wednesday, May 28th

Text Message:

Lead Activation Text (Summer)

Hey Tom—

We’re seeing a wave of new homes hit the market.

Thought I’d check back with you before the summer.

Any real estate plans on the horizon?

Thursday, May 29th

IG Shareable

What its really like to sell your home

Friday, May 30th

Letter

Reasons why people are selling this summer

Tuesday, May 20th

Email:

How much equity have you gained in the last 12 months?

Whenever I prepare equity reports for my clients, most are surprised by how much equity they’ve gained.

And even if they’re nowhere near selling, all of them appreciate having a clearer picture of their finances.

I don’t send an email like this often—just because it takes me some time to dig into the comps, analyze recent sales, and factor in details that algorithms overlook.

But I know a lot of my clients—especially recently—want to know where they stand.

Can I prepare one for your home?

Wednesday, May 21st

Text Message:

$100 Million Text

Hey Tom—

I don’t send a message like this often but I’ve been talking to a lot of clients who are trying to get a better picture of their finances.

I’m setting aside a couple hours this week to help out by preparing them an updated home equity report.

Can I prepare one for you?

Thursday, May 22nd

IG Shareable

I started to think about selling…

IG Shareable

When I tell people I live in [Area], they think…

Friday, May 23rd

IG Shareable

Magic Buyer: I Have 4 Buyers Right Now Who Are Looking For…

IG Shareable

Magic Buyer: Who’s Buying Right Now? 3 Real Requests

IG Shareable

Magic Buyer: 3 (Very Real) Buyer Needs, Right Now

IG Shareable

Magic Buyer: 4 Buyer Needs (Right Now)

Tuesday, May 13th

Email:

The housing stat no one’s talking about

For years, buying a home felt like a reality show where the winner got a mortgage and everyone else got burnout.

Is that finally changing?

In some parts of the market, yes. According to Bright MLS, nearly 40% of buyers in Q1 2025 found a home in under 30 days. Half only made one offer.

Buyers are no longer speed dating with their financial future—or rage-quitting the process.

That doesn’t mean they’re getting everything they want. 45% still compromised—on location, condition, or price.

But the most surprising shift may not be in inventory or competition—it’s in mindset.

Rates are still near 7%, but they’ve ticked down just enough to matter. Over 80% of agents said buyers found it easy to qualify for a mortgage. And the number stepping back due to rates? Down from nearly 60% last year to 42%.

Conditions aren’t perfect. But for many buyers, they’re finally reasonable enough.

Turns out, people don’t need perfection to re-enter the market.

Wednesday, May 14th

Text Message:

Hypothetical Offer (Current Buyers)

Hi Tom,

I'm reaching out to off-market listings today in [Area].

Fill in the blanks for me—

“If I could find a home in _____ (neighborhood) between ______ (price range) that fit my needs, I would seriously consider putting in an offer.”

This is going to help me find you some hidden gems. 🙂

Text Message:

Off-Market Buyer (Prospecting Script)

Hi Tom,

I'm reaching out to off-market listings today in [Area].

If I come across any deals, would you like me to keep you in the loop?

Thursday, May 15th

IG Shareable

How to spot a good deal

Friday, May 16th

Letter

Just Listed: Know Someone?

Text Message:

11% Jump in Mortgage Activity

Hi Tom,

There’s been a lot of noise lately.

But today’s 11% jump in mortgage activity and a strong stock rally say something’s shifting.

Would it be helpful if I put together a quick market snapshot for you?

Tuesday, May 6th

Email:

Why do homes that sell in May make the most money?

Every market has its season—and May isn’t just another month on the calendar.

It’s when sellers statistically have the upper hand. According to ATTOM’s new analysis of 47 million home sales over the past decade, homes that close in May deliver the highest return—on average, 9.5% above market value.

So… why May?

Because the housing market isn’t rational—it’s emotional.

Spring makes people move. School calendars create urgency. Warmer weather makes home tours more inviting. And for many, it’s simply a season of transition—jobs shift, leases expire, and there’s that universal itch to start fresh before summer. That emotional momentum? It shows up in the numbers.

I’m not telling you to list your home tomorrow.

But I do believe having the right data leads to better decisions.

That’s my job—to help you see the bigger picture, spot the patterns, and stay informed, so you’re never navigating blind.

Wednesday, May 7th

Text Message:

Cold Lead Activation

Hi Tom,

I know this is probably catching you off guard, but if I found a home that checked all your boxes—for the right price—would you consider making a move?

We’re seeing a ton of new listings hit the market, and even I’m surprised by how many solid, move-in-ready homes there are.

Thursday, May 8th

IG Shareable

Working In Public

Friday, May 9th

Letter

We don't wait for buyers

Tuesday, April 29th

Email:

🧐 33.9% of homes took a price cut—should we panic?

You’ve probably noticed it too—more listings with price reductions this spring.

In March 2025, 33.9% of homes for sale on Realtor.com saw a price cut—the highest share in years.

So…should we panic?

Nope. We just need more context.

Yes, today’s buyers are cautious and calculated.

But even at the height of the 2021 housing boom, nearly 1 in 5 listings still saw a price cut. (Source: ResiClub)

A price cut doesn’t always mean a home sold for less—sometimes it’s strategic, meant to test demand or leave room to negotiate.

That said, not every cut is planned. Some are course corrections when the market doesn’t respond as expected.

And with inventory climbing, construction pulling back, and buyers weighing every move—that response is getting harder to predict.

It’s a market that’s easy to misread—and one that takes experience to navigate well.

P.S. Even if you’re in the very early stages of planning a move, I can walk you through what to expect—from timing to pricing to prep—so you’re not scrambling later. Just reply to this email.

Wednesday, April 30th

Text Message:

Sphere Touch

Hey Tom—

There’s been a lot of noise about how tough the market is, but this stood out:

123 Main St in Auburn just sold in 3 days—85% faster than similar homes.

A good reminder that with the right strategy, results like this are still possible.

Curious—how closely have you been following our market?

Thursday, May 1st

IG Story

Spring Reminder

Friday, May 2nd

🎥 Video Template: [City 1] vs [City 2] | Which Market Is Better for Buyers & Sellers in 2025?

Use this video format to compare two of your state’s hottest real estate markets—perfect for showcasing your local expertise and helping clients make confident moves.

Thumbnail Design

Get Canva ThumbnailCopy & Paste Content

Video Title

[City 1] vs [City 2] | Which Market Is Better for Buyers & Sellers in 2025?

Video Description

In this side-by-side breakdown, I compare two of [Your State]’s most talked-about communities to help you understand where the real opportunities lie—whether you're buying, selling, or investing this year. We’ll cover:

– Median home prices and market momentum

– Where sellers have the most leverage

– Buyer advantages in each market

– Lifestyle and community differences

– What’s really driving demand in both cities

No hype, just strategy—so you can make the right move with confidence.

📍 Want a custom breakdown based on your goals? Drop a comment or reach out directly.

📩 Subscribe for weekly insights on your local market.

Hashtags

#[City1]RealEstate #[City2]RealEstate #CompareMarkets #MovingTo[State] #RealEstate2025 #LocalMarketUpdate

Mailer

Just Listed: Seller Activation

Tuesday, April 22nd

Email:

70% of sellers think it’s a ________ time to sell…

I just finished reading a new survey from Realtor.com:

70% of potential sellers think it’s a good time to sell.

At first glance, that might sound out of touch—especially with so much economic uncertainty and mixed messages in the headlines.

But when you look closer, it makes more sense. It’s not about timing the market—it’s about life. Job changes, growing families, downsizing, rising costs.

Most sellers aren’t chasing ideal conditions—they’re making the best decisions they can.

81% believe they’ll get their asking price or more.

Why? Because inventory is still low—30% below pre-2020 levels—and the average homeowner now holds just 48% loan-to-value, the strongest equity position in a decade.

I know this market can feel overwhelming—especially when no one really knows what’s coming next.

But I’ll keep sharing what I’m seeing.

Email:

This home outperformed the market—here’s why

The reason we obsess over how your home presents online is because of this:

We just sold 123 Main Street in [#] days for [%] above the list price.

That’s [%] more than the average home sale in [Area].

This is a photo of the home before we brought in our professional photographer:

[insert “before” photo]

And after?

[insert “after” photo]

The difference isn’t just aesthetic—it’s strategic.

Buyers don’t just see homes online. They screen them. Fast.

That’s why we invest in professional prep and photography. Because the right first impression can lead to more attention, stronger offers, and faster results.

If selling is on your mind and presentation matters to you, we should talk.

Call or text me anytime at 555-555-5555.

Wednesday, April 23rd

Text Message:

The Economic Impact Text

Hey Tom,

I just wrapped up with one of my clients who’s thinking about selling and thought of you.

Has anyone sat you down to walk you through how the current economic changes are going to impact your home’s value?

Thursday, April 24th

IG Story

Just Sold IG Poll

Friday, April 25th

Mailer

Did you hear about your neighbor?

Tuesday, April 15th

Email:

The next 90 days.

Let’s call it what it is: the last few weeks have been confusing—economically, politically, and emotionally.

Many people have hit pause on their real estate plans, unsure of what’s coming next.

We don’t have a crystal ball, but we do have a clearer sense of what the next 90 days might look like—and that’s already sparked momentum.

I’ve had several people reach out to revisit plans they’d put on hold and take another look at their timelines.

I don’t know if any of that resonates with you.

But if you’re feeling a bit in-between—curious, cautious, or reconsidering—I’d be happy to talk through what’s realistic right now based on the local market.

Either way, I’m here. We’re all just trying to make sense of things in real time—and if I can help, I’m happy to.

Wednesday, April 16th

Text Message:

The Next 90 Days

Hi Tom,

A lot of people hit pause on their real estate plans, unsure of what’s coming next.

But now that we’ve got a clearer sense of the next 90 days, several people have reached out to revisit their timeline.

Out of curiosity—would it be helpful to talk through your plans?

Love to help any way I can.

Thursday, April 17th

What do you think is missing in [Area]?

Friday, April 18th

Pre-forclosure Letter

Tuesday, April 8th

Email:

Most Realtors wouldn’t share this with you…

We’ve all heard the expression: Now is a great time to buy!

But is it really?

A recent post from real estate data journalist, Lance Lambert, stopped me in my tracks…

IF U.S. incomes spiked 69%, we'd return to pre-pandemic housing affordability levels.

IF U.S. home prices fell 41%, we'd return to pre-pandemic affordability.

IF mortgage rates fell 4.3 percentage points, we'd return to pre-pandemic affordability.

So the short answer is—affordability is an issue.

So is it a great time to buy?

The answer is—it really depends on your timeline.

If you’re planning to buy a home for the purposes of putting a fresh coat of paint on it, cleaning the carpets and trying to resell it in 18 months for a 20% gain, you’re going to get crushed.

But if you're like most homeowners—who buy and keep their home for an average of 12 years, then it could be a great time to buy.

Inventory is up nationally 30.6% year-over-year (Altos Research) and we’re no longer seeing the frenzy of the 2021 real estate gold rush.

I hope you found this helpful and as always, I’m here if you have any questions.

Email:

Are you paying too much for your real estate taxes?

Just got my new tax assessment in the mail—

According to the county, my home’s value went up [X%].

(That’s… generous.)

I’ll be appealing. And if you’re in the same boat, I’d be happy to help you too.

I’m setting aside a few hours this week to run comp reports for neighbors who want to double-check the county’s numbers.

These reports are based on actual sales data—not automated estimates.

They’re what appraisers and attorneys use when filing an appeal.

Want me to send you one for your property?

Wednesday, April 9th

Text Message:

The Equity Check Text

Hi Tom,

With all the economic uncertainty lately, a lot of homeowners are wondering what it all means for their equity.

Has anyone walked you through how much equity you’ve gained—or lost—in the past 12 months?

Thursday, April 10th

Instagram Story:

Underrated Neighborhoods

Friday, April 11th

🎥 Video Template: 8 HUGE Changes Coming to [Your City] in 2025

Use this format to share exciting development and market changes happening in 2025. Great for creating timely, valuable content that positions you as a knowledgeable local expert.

Thumbnail Design

Get Canva ThumbnailCopy & Paste Content

Video Title

8 HUGE Changes Coming to [Your City] in 2025

Video Description

[Your City] is transforming—and 2025 is going to be a massive year for growth, development, and opportunity. In this video, I’m breaking down 8 exciting changes you need to know about, whether you’re planning to move here, invest in real estate, or simply stay informed.

From new communities and local infrastructure improvements to real estate trends and lifestyle shifts, this is your full update on what’s ahead for [Your City] in 2025.

📌 In This Video:

0:00 Intro

0:45 Big picture growth

1:30 Infrastructure trends

2:45 Lifestyle shifts

4:00 Business & commercial updates

5:15 Housing & new construction

6:30 Up-and-coming neighborhoods

8:00 What it means for buyers, sellers & investors

9:00 Call to action & next steps

Thinking of buying, selling, or investing in [Your City]? I’d love to be a resource for you. Here’s how we can connect:

📲 Text/call: [Your Phone Number]

📧 Email: [Your Email Address]

🌐 Website: [Your Website URL]

📍 Search homes in [Your City]: [Link to Home Search Page]

📢 Don’t forget to subscribe for weekly updates on:

✔️ Living in [Your City]

✔️ Real estate market insights

✔️ Local neighborhood tours

✔️ Buyer & seller tips

✔️ Hidden gem communities

🔔 Subscribe here: [Insert Channel Link]

Let’s connect on social:

Instagram: [@YourHandle]

TikTok: [@YourHandle]

Facebook: [Your Page Link]

Hashtags

#LivingIn[YourCity] #YourCityRealEstate #MovingTo[YourCity] #RealEstate2025 #YourCityRealtor

Tuesday, April 1st

Email:

Trying to make sense of this market?

You’ve probably seen the headlines—prices are high, affordability is low, and the market feels like a waiting game no one wants to play.

But the latest data tells a more nuanced story.

For the first time this year, weekly home sales topped 2024 levels. Inventory is up 30% year over year. And the median home price? Just 1% higher than this time last year. (Altos Research)

Nationally, the market is moving—but prices aren’t surging.

Affordability is still a hurdle. A typical home now eats up 32% of the average U.S. wage—above the 28% lending benchmark. (ATTOM Data)

Of course, real estate is local. Some areas are still seeing bidding wars and above-ask offers. Others? More price cuts, longer days on market, and more room for buyers to negotiate.

It all depends on your neighborhood, your price point, and how much competition there is on either side.

This spring isn’t one-size-fits-all. I’ll keep you informed as the market evolves.

P.S. I’d be a terrible Realtor if I didn’t ask: If you were to get a great offer for your home, would you consider selling? If yes, just reply to this email—let’s talk.

Sincerely,

[Your Name]

Wednesday, April 2nd

Text Message:

Cold Lead Activation

Hi Tom,

I know this is out of the blue, but I’m working with a couple serious buyers who are hoping to move before summer.

Wondering if there’s a number that would make the conversation worth having—even if selling wasn’t your plan for this year.

Thursday, April 3rd

Is moving on your mind for 2025? Instagram Story

Friday, April 4th

🎥 Video Template: 10 Realities of Living in [Your Area]

Use this video format to share real insights about what it’s truly like to live in your area—from lifestyle to cost of living. Perfect for building trust and showing your value as a local expert.

Thumbnail Design

Get Canva ThumbnailCopy & Paste Content

Video Title

10 Realities of Living in [Your Area]

Video Description

Thinking about moving to [Your Area]? In this video, I break down 10 things you need to know before making the move—based on my own experience living here for the past [#] years. From the real cost of living and housing options to local food, outdoor lifestyle, and what everyday life actually feels like... this is your insider’s guide to [Your Area].

Whether you're relocating for work, lifestyle, or just curious about what it’s like to live in [Your Area], this video will give you a real-world look at:

✔️ Pros and cons of living in [Your Area]

✔️ Housing and neighborhoods

✔️ Jobs and economic opportunities

✔️ Local culture, food, and outdoor life

✔️ What surprises most people when they move here

📍 Want more info on buying or selling in [Your Area]? Reach out anytime at [Your Website] or DM me on Instagram at [@YourHandle].

👉 Don’t forget to like, subscribe, and hit the bell for more local updates, housing market insights, and neighborhood tours in [Your Area].

Hashtags

#LivingIn[YourArea] #MovingTo[YourArea] #RelocateTo[YourArea] #CostOfLiving[YourArea] #BestPlacesToLive #LifeIn[YourArea]

Mailer

What most people don’t know about the neighborhood market right now

Tuesday, June 24th

Email:

"4 ways to improve your rate without waiting for the Fed”

The Fed held rates steady last week—and penciled in two cuts later this year.

While—yes—we’re still in a high rate environment, there are levers buyers can pull that make a real difference.

Here are 4 rate strategies that are working in today’s market:

Shop around: According to Realtor.com, buyers who compared lenders shaved 0.86% off their rate. That’s thousands in savings, just for making a few extra calls.

Improve credit score: Raising it into the “very good” range can lower a rate by around 0.22%, based on current lender pricing models and data from Fannie Mae and the Consumer Financial Protection Bureau.

Increase your down payment: Even a modest bump (say, from 10% to 15%) can reduce your rate—and eliminate PMI.

Consider a temporary buydown: In some cases, sellers or builders will cover a 2-1 buydown. That means a 2% lower rate the first year, 1% the second—easing you into the full rate.

None of these are magic. They all require effort, tradeoffs, or timing. But they work.

If you're watching the market closely, I hope this is helpful.

Text Message:

Shaw Energy Solar Summer Promo

Hey (name) - it's (agent name). Hope the family is doing well.

I'm not sure if you've been keeping up with the news but THIS SUMMER will most likely be the FINAL time ⏰ to save 30% off solar! Congress has pushed to end it.

You want me to put you in touch with my solar ☀️ pro? Our office partnered with them and they are zero pressure.

Wednesday, June 25th

Text Message:

Have you given up on trying to buy a home this year?

e Off-Market Opener

Hi Tom—

Have you given up on trying to buy a home this year?

Thursday, June 26th

IG Shareable

“I wanted to buy a home this year but about to give up because…”

Friday, June 27th